Invest in Tech or Die… How MCA Evolves

By Sol Lax, CEO of Pearl Capital | December 2018

I recently spent some time with a smart ex-Goldman guy who invested in MCA. He told me that he doesn’t spend money on technology because it’s his f-cking money. Well at Pearl it’s also our money, and we tend to be on the frugal side with the exception of spending on things that make us money. However, we have about as many people in technology at Pearl as in sales which is unusual for MCA. Why?

Well for our basic MCA product, scalability, speed, and credit is impossible without automated scrubbing, a data warehouse with analytical capability, and an ERP System for which we use Salesforce. You can run a profitable small MCA company with human scrubbers, limited data collection, and without portfolio credit analysis, but you will likely run a default rate 300 basis higher than if you had the data and analysis. You will also find your processing time stretching interminably as your volume rises, especially since demand is very volatile. Processing time affects more than just your customer’s level of satisfaction. In the aggressive and competitive MCA market, time is money. To be last usually means to lose, unless you are always the highest bid. Another trend is to require connection to larger partners by API. An API is not cutting edge technology, but complex enough to require an expert tech team. Finally, online checkout and instant decisioning for most transactions will become standard for larger enterprises by the end of next year.

“Without technology you miss the most valuable element of MCA which is that it is the ideal lab environment for financial innovation”

Of greater importance is that without technology you miss the most valuable element of MCA which is that it is the ideal lab environment for financial innovation. MCA has four unique elements; its daily ACH remittance which gives you real time information about the success of your credit decision, its short deal lifetime, its focus on bank cash flow forecasting, and its subprime nature. If you want to experiment with credit, experience rapid results, correct quickly, and work with an alternative to FICO scoring, MCA is ideal. It does require a team of data scientists and quant developers, which is not cheap. However, the platform capabilities of small business non FICO credit scoring and cash flow forecasting of bank statements are essential for product extensions beyond MCA.

Since April, we have been using our machine learning models to scrub all our bank statements and make credit decisions on smaller transactions. So far we like the results, and since an MCA pool takes about five months to fully mature we are not guessing. The very material improvement in speed is creating bottom line results. An unfair advantage we have over Fintech startups is $500M in completed human underwritten transactions and gifted underwriters helping to build the models. We are in beta with a Salesforce Package and an API for larger partners that want to submit directly from their system. For those who already have DecisionLogic as part of their submission or can direct their clients to a Yodlee link, we will offer full contract execution for fundings up to $25k. By the end of q1 we will be launching our Sky Bridge portal which will enable full execution for transactions below $25k for partners that don’t have Salesforce or want an API. We think it will help our bottom line.

Next year, we intend to have a line of credit product. If we get lucky, we may also be able to launch a small business credit card linked to bank account cash flow with overdraft protection as an added feature. If we can predict cash flow for credit modeling, we can predict it for overdraft protection as well. I don’t imagine banks will be ecstatic, but it will help our small business population who is spending a great deal on overdraft fees.

So yes. We try to buy our furniture used and office space subsidized and refuse to pay WeWork rates. We alas don’t have any sleep pods, just a couch or two. But we are willing to pay up for tech if it is the lever that can move our world.

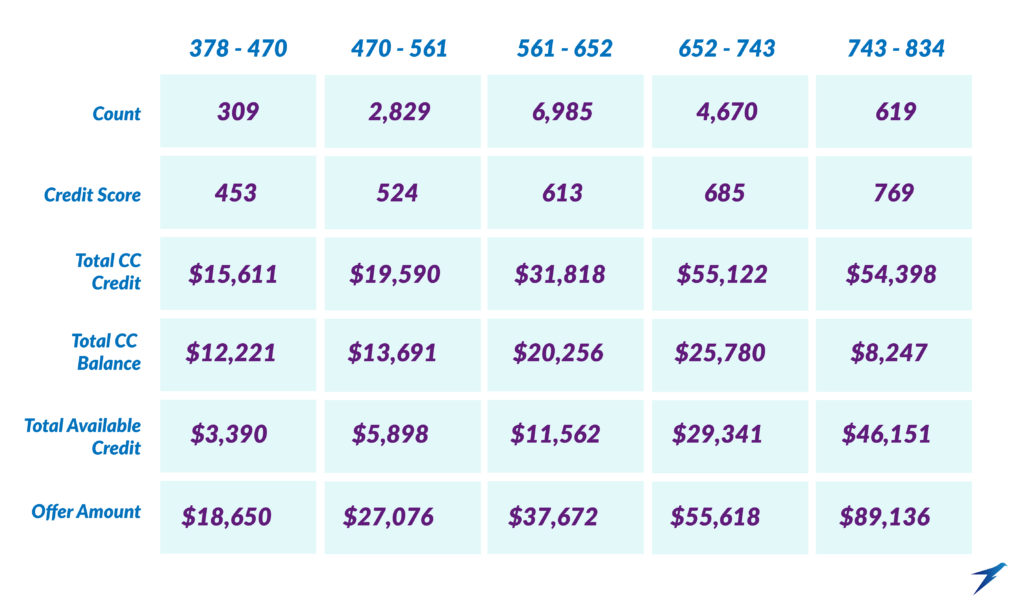

As an example of the power of alternative scoring in credit creation below is a chart depicting the average credit extended by FICO score compared to their credit cards. Offer amount is the amount Pearl extended to them.

As an example of the power of alternative scoring in credit creation below is a chart depicting the average credit extended by FICO score compared to their credit cards. Offer amount is the amount Pearl extended to them.

Other Newsletters

PRESS: Pearl Capital Business Funding LLC Resumes Merchant Cash Advances After Processing $1.75 B in PPP Loans

PRESS: Pearl Capital Business Funding LLC Resumes Merchant Cash Advances After Processing $1.75 B in PPP Loans  What’s New at Pearl Capital

What’s New at Pearl Capital  What the Bloomberg and Yahoo Articles Get Wrong About MCA

What the Bloomberg and Yahoo Articles Get Wrong About MCA

Tools

Tools  Webinars

Webinars  Guides

Guides  Videos

Videos  Comics

Comics  Newsletters

Newsletters